Funding Pips cTrader

Limited Time Offer – Conditions Apply

What Is Funding Pips cTrader?

Funding Pips includes cTrader among the platforms it offers for trading on evaluation and funded accounts. cTrader is known in the trading world for offering direct access trading (also called DMA — Direct Market Access), detailed charting tools, and fast execution without intervention.

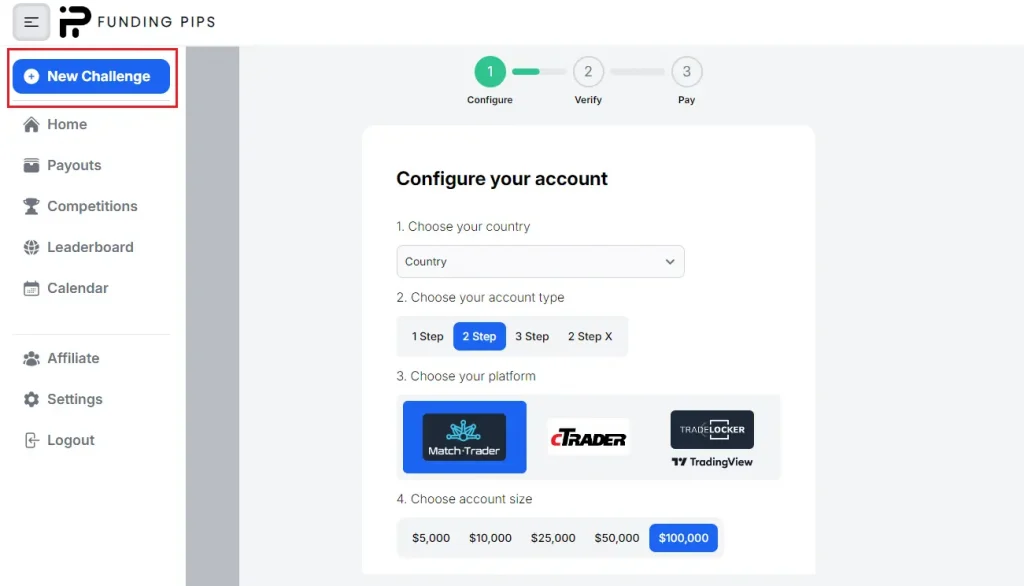

According to the official site, traders who choose the cTrader option can use the platform in all three funding models:

- One-Phase Evaluation

- Two-Phase Evaluation

- Instant Funding

The accounts linked with cTrader follow the same profit targets and drawdown rules as accounts running on MetaTrader 5 or Match-Trader.

Key Features of Funding Pips cTrader

Funding Pips does not develop the platform itself — it integrates the cTrader technology through its prop trading infrastructure. This gives users access to a well-supported, third-party platform with a range of technical advantages.

Core Features Available in cTrader at Funding Pips

- Customizable charting with multiple timeframes and layouts

- More than 65 built-in indicators

- Detachable charts for multi-screen use

- Depth of market (Level II pricing)

- One-click trading with adjustable lot sizes

- Cloud-synced watchlists and layout storage

- Integrated economic calendar

- Support for algorithmic trading via cAlgo

All features are consistent with cTrader’s own system design, and Funding Pips makes no functional restrictions on the platform usage (aside from standard risk and trading rules that apply to all accounts).

cTrader vs MetaTrader 5 at Funding Pips

Feature | cTrader | MetaTrader 5 |

Platform Provider | Spotware | MetaQuotes |

Charting Tools | 65+ indicators | 38+ indicators |

Algorithmic Trading Support | Yes (cAlgo) | Yes (MQL5) |

Execution Speed | Fast, Direct Market Access | Fast, Market Maker / Hybrid |

Mobile App | Yes | Yes |

Web Version | Yes (modern UI) | Yes (basic UI) |

Strategy Backtesting | Advanced | Available |

Platform Restrictions | Not available for U.S. residents | Available globally |

Account Configuration and Rules on cTrader

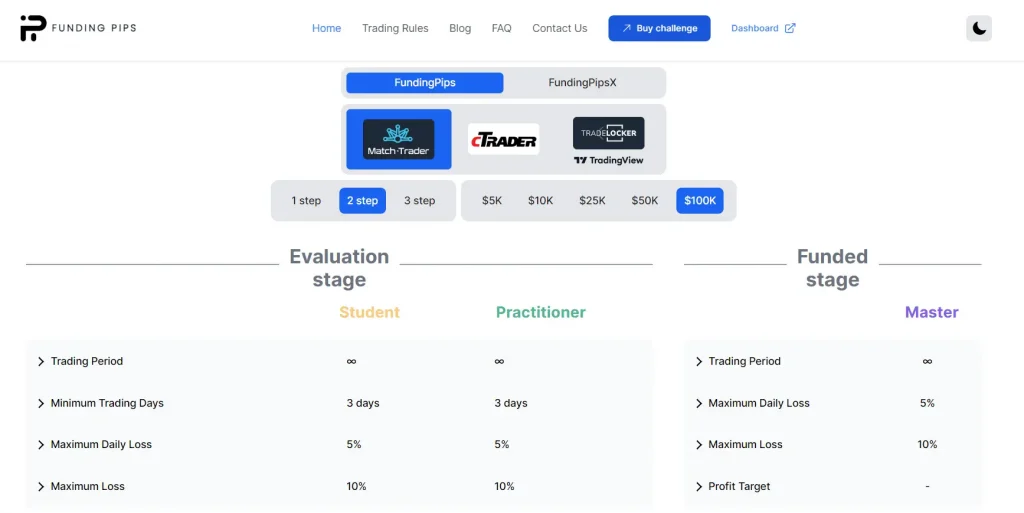

The rules for trading using cTrader accounts are identical to other platforms under Funding Pips programs. These include:

- Max drawdown: 5% on the account balance or equity

- No daily drawdown limits

- Trading hours: 24/5 except during restricted events (such as high-impact news)

- Minimum trading days: Varies depending on the program selected

- Payout eligibility: First payout available after 14 calendar days on a funded account

- Scaling plan: Active on cTrader accounts as long as targets are met

These rules are enforced across all platform types and apply uniformly to ensure fairness between participants.

Availability and Limitations

Geographic Restrictions

One of the main limitations related to Funding Pips cTrader is platform availability by region. Specifically:

cTrader accounts are not available to residents of the United States.

This is due to cTrader’s own compliance and licensing limitations, not something controlled by Funding Pips. Traders in the U.S. are therefore limited to MetaTrader 5 or Match-Trader when working with this firm.

Mobile and Web Access

Funding Pips allows the use of cTrader through:

- cTrader Desktop

- cTrader Web Terminal

- cTrader Mobile App (iOS and Android)

These access points are fully functional and supported, offering real-time syncing of layouts, orders, and preferences.

Considerations Before Using Funding Pips cTrader

Although cTrader is powerful, there are a few operational and administrative elements to keep in mind:

Pros

- Professional-grade execution and interface

- Multiple access points (web, desktop, mobile)

- Better visual tools and analytics than MT5

- Full support for algorithmic trading

- Platform updates more frequent than MetaTrader

Cons

- Not available for U.S.-based users

- Some EAs made for MT4/MT5 are not compatible

- Funding Pips does not provide platform-specific support; issues must be addressed to Spotware (cTrader provider)

- Delays in KYC and payout processing affect cTrader accounts the same as other platforms

Conclusion

Funding Pips cTrader offers a serious option for traders who prefer a sleek, customizable, and technically advanced trading platform. It brings better analytics, faster execution, and algorithmic flexibility. The integration within Funding Pips’ structure is consistent with other supported platforms — rules, funding conditions, and payout schedules do not vary by platform.

However, if you’re a U.S.-based trader or rely heavily on MT5-compatible bots, cTrader might not be accessible or suitable. Moreover, as with all Funding Pips programs, the experience relies heavily on clear compliance with trading conditions and proper timing of KYC verification.

In summary, cTrader at Funding Pips offers technical advantages but requires the same level of caution and due diligence as any other prop firm environment.

FAQ

Yes, cTrader is available for One-Phase, Two-Phase, and Instant Funding models.

No, payout rules and schedules are the same across all platform types.

Yes, as long as they comply with cTrader’s technical framework and Funding Pips’ trading rules.